Disposables and after

December 14, 2024

The disposable vape market has been a cornerstone of the vaping industry, and a major sales driver for convenience stores. However, the landscape is set to change significantly with the impending ban on disposable vapes across the UK, scheduled for June 2025.

This means that from June 1, 2025 it will be illegal for retailers to sell, offer to sell or have in their possession for sale disposable vaping products in their shop or on their website.

Retailers should sell through all existing disposable vaping products before 1 June to avoid commercial loss and enforcement action. From 1 June, it is an offence to have disposable vaping products in your possession for sale. Any leftover disposable vaping products must be stored in stock rooms or back offices, away from the shop floor, and clearly separated from other goods and clearly labelled as not for sale.

The government says the ban will protect children’s health and tackle “throwaway” culture. Announcing the measure in October, public health and prevention Minister Andrew Gwynne said it was “deeply worrying” that a quarter of 11 to 15-year-olds used a vape last year.

“Banning disposable vapes will not only protect the environment, but importantly reduce the appeal of vapes to children and keep them out of the hands of vulnerable young people,” he said.

Plans to ban single-use vapes were first announced in January by the previous Conservative government but not enacted before it lost power in July.

Junior environment minister Mary Creagh said discarded vapes were “extremely wasteful” and a “blight” contributing to a flood of litter on the nation’s streets.

According to the government, vaping in England increased by more than 400 per cent between 2012 and 2023, with 9.1 per cent of the public now using them.

The shift to reusable products

The surge in disposable vapes has been a defining trend in recent years, with their usage growing from 2.3 per cent in 2021 to 31 per cent by 2023, as per the annual Smokefree GB survey by public health charity Action on Smoking and Health (ASH). Despite a slight stabilisation, they still represented 30 per cent of vapers’ primary devices in the 2024 survey, published in August.

The looming ban is expected to reshape the market. Among younger adults (18–24), disposable vapes were the preferred choice for more than half of users in 2023 (57%), but their popularity has started to decline, particularly among the 25–34 age group, where usage dropped from 47 per cent in 2023 to 29 per cent in 2024.

As the market shifts, retailers are rethinking their strategies to cater to changing preferences and upcoming regulations.

David Wyatt, manager of the Costcutter-Bargain Booze store in Crawley, exemplifies this proactive approach. Between May and September 2024, Wyatt’s store recorded £120,000 in vape sales by staying ahead of trends and guiding customers toward reusable systems.

“We’re managing with explaining the benefits of the cost savings for customers, because ultimately, they need to go on to a rechargeable product,” he recently told Vape Business.

Wyatt’s collaboration with Liberty Flights has helped his store build a robust liquid-based product offering, complemented by purpose-built in-store display units. These units allow staff to manage the vape section securely from behind the counter, enhancing efficiency and safety, particularly during evenings.

“Over the last two years, we have navigated all the ranges. Now, over the last six months, obviously, it’s been a shift to the pods, and we’ve managed that,” he has said.

Embracing change

The rise of reusable vapes, prefilled pods, and heated tobacco products marks a significant transformation in the vaping market. Retailers like Nikesh Patel, who runs a Costcutter store in Northampton, are already seeing success with products like the Elfa Pod system, which uses pre-filled e-liquid pods. With several brands introducing such products, he feels they are good candidates to replace disposables.

“Aquavape introduced Elfa Pod mid last year, and we’ve been pushing customers to try this reusable option,” Patel has said. “SKE has got theirs, IVG has got theirs. They’ve all got theirs now. And I know that eventually, they will take over the disposables.”

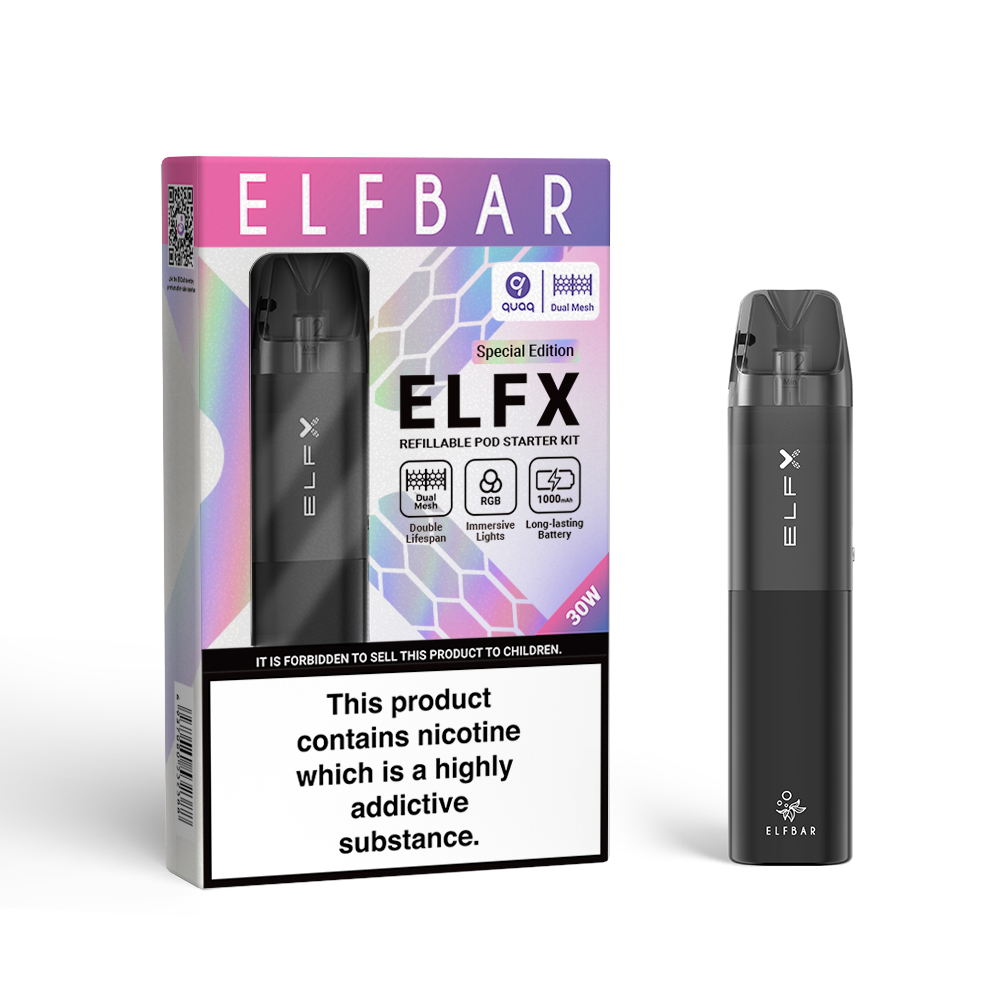

Wyatt has also observed this transition to the 4 in 1 vape kits from the leading disposable vape brands. “You’re seeing a lot of maneuvering by whether it’s Elfbar, Crystal, Gold bar, or IVG, they’ve got the four in one, the 10,000 puff pods. If you are loyal to a brand, they’re putting out the large product now. So, by the time the ban comes in, I think most people will have converted to a larger product anyhow.”

Patel has dedicated an additional meter of display space to prefilled pods, and products like the IVG 2400 four-in-one are performing exceptionally well.

Sheetal Sisodiya, owner of SPAR Linford in Hampshire, echoes the sentiment of adaptability. “We’ve started doing the reusable vapes and have already seen the shift from the disposables to the reusable ones. And people have also started switching to Heets and Terea (sticks, designed for use within IQOS devices), as well,” she has said.

Imperial Brands has also joined the reusable revolution with its newly launched blu bar kit, a sleek, lightweight vaping device offering up to 1,000 puffs per pod. Designed to bridge the gap between disposables and reusable systems, the blu bar Kit provides convenience, style, and sustainability.

The device features a rechargeable 550mAh battery, USB-C charging, and enhanced safety through a security lock. A translucent pod design enables users to monitor e-liquid levels easily, while the innovative mesh coil delivers intensified flavours, including Cherry, Pineapple, Blueberry Sour Razz, and Watermelon Ice.

“As consumers search for vaping solutions that provide even more intense flavours, ease of delivery and competitive pricing, we believe the blu bar kit offers a significant sales opportunity for wholesalers and retailers alike, as well as providing another revenue stream ahead of the proposed disposable vape ban,” Yawer Rasool, UK&I consumer marketing director for Imperial Brands, has said of the new launch, which was rolled-out to UK wholesale and independent retail channels first.

Angelo Yang, associate general manager for Elfbar UK, has underscored the importance of guiding customers through the transition.

“For smokers and former smokers who have already made the switch and rely on single-use vapes, retailers should highlight the availability of reusable products to encourage their transition to viable alternatives. This will also help retailers maintain sales post phase-out,” he has said.

“Retailers should highlight reusable products as viable alternatives to disposables. This helps maintain sales and encourages customers to adapt to the new market dynamics,” he has said.

Innovative solutions for the future

Sales trends show a growing preference for high puff count devices, which are both cost-effective and sustainable. Elfbar’s AF5000 and Lost Mary’s BM6000 high puff count devices are gaining traction for their cost-effectiveness and sustainability. These reusable systems hold more e-liquid than disposables, making them an attractive option for budget-conscious customers.

Flavours remain a key driver of customer preference. Fruit continues to be the most popular flavour with adult smokers and ex-smokers, as evidenced by the Action on Smoking and Health 2024 adult vaping survey and member-commissioned research by the Independent British Vaping Trade Association. In terms of sales, some of the most popular flavours include Pineapple Ice, Strawberry Ice, Watermelon, and Blueberry.

Elfbar and Lost Mary have introduced the 4-in-1 prefilled pod kits that offer multiple flavours in a single device. These rechargeable devices bridge the gap between single-use convenience and reusable sustainability.

Additionally, Elfbar’s ELFX series, an open pod system, allows users to customise their vaping experience by adjusting device settings and adding their preferred e-liquid. Such innovations align with the Royal College of Physicians’ recommendation to offer a variety of flavours to aid smoking cessation efforts.

With the vape market in the UK seeing a surge in the popularity of 2 ml + 10 ml products, ICCPP Group, the parent company of Voopoo, has introduced their latest innovation Argusbar Prime in the UK, promising an unparalleled vaping experience.

The sleek and modern design of Argusbar Prime not only enhances its aesthetic appeal but also makes it comfortable to hold and use. Besides, it boasts a range of features, including up to 6000 puffs, adjustable airflow, fast charging, detachable battery, and battery Indicator.

The product offers a diverse range of flavours to choose from, catering to every palate.

“Argusbar Prime represents a significant leap forward in the evolution of vaping technology,” said a spokesperson for Argusbar. “We have listened to the feedback from consumers and have developed a product that not only meets but exceeds their expectations. With its innovative features and exceptional performance, Argusbar Prime is poised to set a new standard for excellence in the vape market.”

Meanwhile, Philip Morris Limited, the UK and Ireland affiliate of Philip Morris International (PMI), is looking to expand its smoke-free portfolio in the UK, launching the closed pod vape product Veev One earlier this year.

As the latest innovation in PMI’s Veev e-vapor range, Veev One features advanced heating technology and premium e-liquids made from high-quality nicotine and food-grade flavourings, ensuring a consistent taste experience.

Since its launch in 2023, Veev One has emerged as the number one closed pod vape system in Italy and Czechia.

“We’re excited to introduce Veev One to the UK market at such a transformative time for the e-cigarette industry,” John Rennie, commercial director at PML, has said at the time of launch in August. “The closed systems market has grown 35 per cent since January, with millions of adult smokers and nicotine users seeking new alternatives.

“As the UK market evolves, Veev One stands out as a premium, responsible, and recyclable, e-cigarette, with proven success across Europe.”

Differentiating itself from traditional devices, Veev One utilises a Compact Ceramic heating technology that delivers consistent taste and a low-level e-liquid detection system, designed to keep flavour alive by preventing burnt taste. With no refilling or cleaning required, a rechargeable battery, and up to 1000 puffs per 2ml pod, Veev One offers legal age users a hassle-free, reliable, and long-lasting vaping experience.

Veev One launches in the UK with a recycling programme, rewarding consumers for returning pods and devices for recycling and responsible disposal free of charge. Participants receive a £5 reward toward their next purchase from the IQOS online store.

Regulatory challenges and opportunities

The impending disposable vape ban is part of broader regulatory efforts under the Tobacco and Vapes Bill. Proposed measures include changes to how vapes are displayed in shops, restrictions on flavours and packaging, and new labelling requirements. While these regulations pose challenges, they also present opportunities for retailers to position themselves as trusted advisors to customers navigating the transition.

Educating customers about the cost-effectiveness and environmental benefits of reusable systems is a vital strategy. Displaying clear signage, offering product demonstrations, and training staff to explain the features of reusable products can help build customer trust and loyalty.